Rents highlight Australia's economic Achilles heel, but it's not what you might think

There's no doubt many renters are in a world of pain right now.

CoreLogic data shows asking rents jumped 8.3 per cent last year, after a 9.5 per cent jump the year before, and 9.6 per cent the year before that.

According to a survey by financial comparison website Finder, nearly two-thirds of renters say housing costs are causing financial stress.

But, as painful as the increase in rents has been, it's still only just ahead of the increase in home values over those same three years from 2020-2023.

Go back further and there's no contest. For all but three of the past 11 years housing prices have grown faster than rents. Usually much faster.

In fact, 2023 was the first time in the past decade where rent rises outpaced capital gains on housing without home values falling.

The reason the recent, unusually large, surge in rents has gathered such attention is that there are a lot more losers than winners.

Even though most Australian landlords own just one investment property, there are still plenty with two or more.

Ipso facto, there are many more renters than landlords.

The rise in home values is very different. At the moment, there are many more home owners than those trying to buy a home — although this is inexorably changing as home ownership rates dive among all but the oldest age groups.

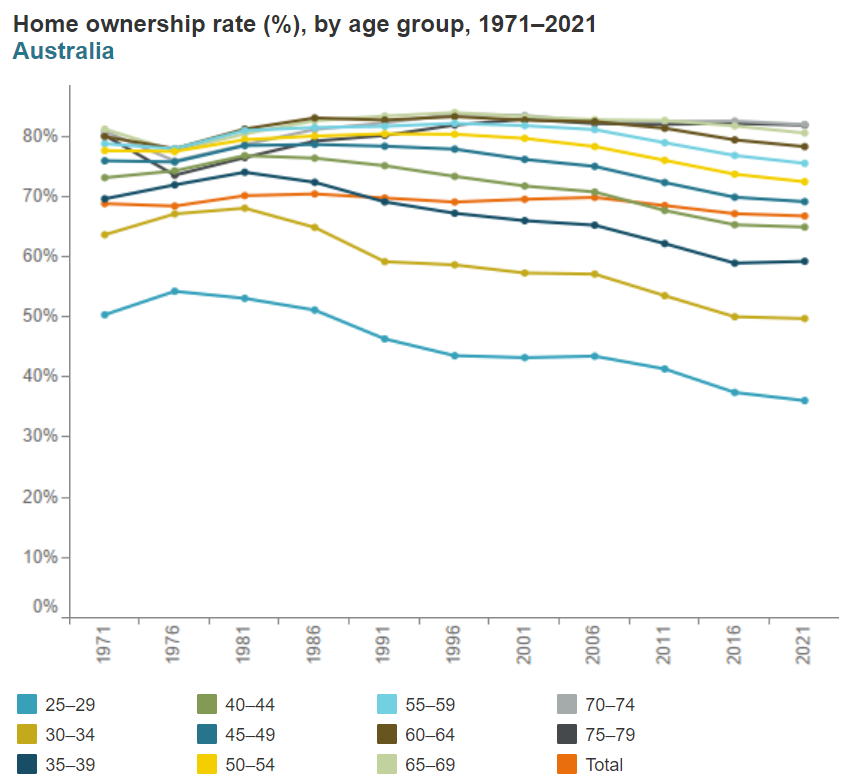

Home ownership rates have been falling for most age groups, but the younger the group generally the steeper the decline.(Supplied: AIHW)

A bit over two-thirds of Australians see their wealth increase because of rising home values — at least on paper.

What's the problem?

Aside from the obvious one, that home ownership is becoming increasingly out of reach for the third of Australians who aren't already there, there's another huge problem with prices surging far above rents.

It's indicative of a massive misallocation of capital … a waste of money.

When professionals make an investment, they look at the return (or yield) and compare it to the risk they're taking.

The average gross rental yield on residential property nationally was 3.7 per cent in December, according to CoreLogic.

That means the average Australian property investor who purchased a place in December 2023 is initially making a return of 3.7 per cent per annum — and that's before any expenses, like interest costs, management fees and repairs.

In Sydney, it was just 3 per cent.

According to the most recent RBA/APRA data for November, the average variable interest rate on new property investment loans was 6.5 per cent.

In what financial universe is it a good investment to borrow a massive sum of money to receive a return that's half what you'll pay in interest? 'Strayan property, apparently. She'll be right, mate. No worries.

Of course, through negative gearing, you can write off the losses against other income to reduce your tax bill. But you'll still be making losses.

And if rents kept growing at 8.3 per cent per annum for the next five years, then by the end of 2028 your rental yield would have risen from 3.7 to 5.5 per cent — although you literally could have got a higher yield over that period from a bank term deposit.

(Also, if that was to happen, your mortgage interest rate would probably be 10 per cent-plus as the RBA battled to get inflation down, of which rents are a major component).

So, in the end, basically what you're betting on as an Australian landlord is capital gains, which will be taxed at half the rate of any income you actually work for.

Australia's property Ponzi

Any investment that's primarily reliant on capital gain rather than future income generation for its return shares at least one thing in common with a Ponzi scheme.

Both rely on the next investors to pay out the profits of the earlier ones.

In the case of real estate that means a new generation of buyers willing — and able — to stump up more cash to pay a higher price than the previous ones.

That worked a treat while interest rates were falling, boosting borrowing capacity for any given income level. It's much more challenging as rates rise.

Although, with property prices having recovered their 2022 falls nationally, and hitting fresh record highs in Brisbane, Adelaide and Perth, it seems like Australians are up for the challenge.

At the moment, about 35 per cent of home loans, by value, are going to property investors.

But they also help drive property prices more broadly. Those who want to buy a home to live in have to outbid not only other owner-occupiers but also investors to secure one.

So the Australian obsession with investing in low-yielding residential property, encouraged by a tax system that subsidises this behaviour, pushes even those who simply want a place of their own to live in to sink more cash into housing.

As a result, Australians have $10.3 trillion of their wealth tied up in housing, more than three times the value of stocks on the ASX and even dwarfing the $3.5 trillion of superannuation savings.

According to CoreLogic, housing represents 56.7 per cent of household wealth.

That's a lot of money that could be invested in new businesses and technology to spur economic growth, or used to buy stakes in foreign firms (or even a bigger share of Australia's own mining and energy sector) to boost the national current account balance.

Instead, we tie up the majority of our wealth in the value we put on land we've already occupied, and now buy and sell from each other to the tune of more than $400 billion each year.

It's great for the banks that lend the money, the real estate agents and state governments who take their cut from the transactions, those who already own a lot of land and can earn more from simply sitting on it than they would by developing it. But at what cost to Australia?

The biggest cliché of popular personal finance books is to avoid putting all your eggs in one basket.

But, as a nation, that's exactly what we've done with housing and, even without a major property crash in recent history, we're already a lot poorer for it.