Finally! RBA cuts rates by 25 points — Aussies cheer as property prices set to jump $141K!

//Foreword//

Just in!

The RBA has officially announced a major policy shift—

the good news everyone’s been waiting for is finally here!

Experts share their tips:

One simple trick could save you $90,000 in interest

and help you pay off your mortgage years earlier!

#01:

Domestic Inflation Eases, RBA Cuts Rates by 25 Basis Points

Just in — the Reserve Bank of Australia (RBA) has announced its latest monetary policy decision: a 25 basis point interest rate cut!

Image source:RBA

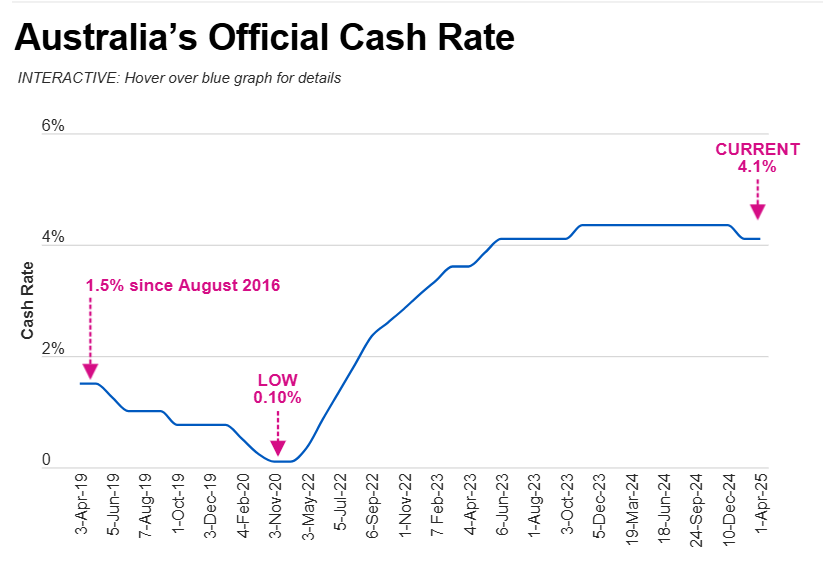

Ahead of the decision, economists and financial markets widely anticipated the move. Following the Trump administration’s tariff policies and their ripple effects on the markets, a 0.25% cut to the cash rate was seen as almost certain — especially as domestic inflation pressures have now eased.

One of Australia’s Big Four banks, the Commonwealth Bank (CBA), has made a bold statement: Australia’s battle against inflation has been won, and a cycle of consecutive rate cuts may be on the horizon!

Image source:news.com.au

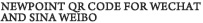

Looking at the data, although inflation figures came in higher than expected, the overall trend shows a significant decline in Australia’s inflation rate since its peak in 2022.

Most importantly, the key indicator that the RBA watches closely—and which has the greatest impact on rate cut decisions—has fallen into the target range for the first time in three years.

Image source:abc.net.au

In April, 89,000 Australians found jobs, and wage growth came in stronger than expected. A high level of employment typically means more people with income, which in theory leads to increased spending and upward pressure on prices.

However, the Commonwealth Bank maintains that inflation remains under control, even in this environment, and has called for a return to interest rate normalisation.

CBA economist Gareth Aird remarked,

"In our view, the inflation dragon has been slain."

Meanwhile, Treasurer Jim Chalmers said this week that the strong wage and employment data align with Australia's soft landing outlook—where economic activity slows, but without tipping into recession.

Image source:news.com.au

He said:

“Our wages are rising, and inflation is falling — these are key factors enabling us to achieve a soft landing during a time of global economic uncertainty”

The Commonwealth Bank agreed, stating that the Australian economy has “already achieved a soft landing.”

So, what impact will this rate cut have on mortgage holders?

#02:

How much can your repayments drop? You could save up to $90,000

For mortgage holders, a rate cut doesn’t automatically mean your lender will reduce your repayments. If you want to lower your monthly repayments, you’ll need to contact your bank—via phone, app, or online banking—to ensure your repayments are adjusted to the new minimum.

Customers of Commonwealth Bank (CBA), National Australia Bank (NAB) and ANZ must proactively request changes to their direct debit arrangements.

Image source:news.com.au

Westpac and Macquarie will automatically reduce repayments for customers who are paying the minimum amount and have direct debit set up.

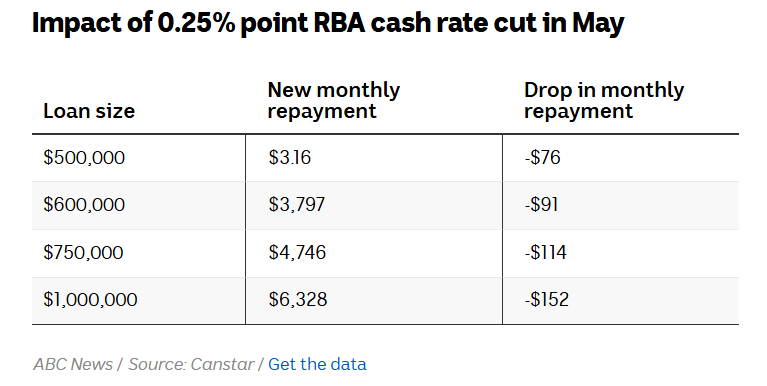

Here’s how much the minimum repayment is expected to drop:

Image source:abc.net.au

(Note: For a $500,000 mortgage, monthly repayments will decrease by $76 to $3,164.)

While lower repayments can ease the burden on borrowers, experts from Canstar warn that maintaining the same repayment amount after a rate cut could save you nearly $90,000 in interest over the life of the loan!

Image source:dailymail.co.uk

Specifically, for an average loan of $600,000 with 25 years remaining, if the borrower continues making repayments at the same level as earlier this year, and assuming two additional 25 basis point rate cuts in August and November, they could save up to $89,143 in interest — and potentially pay off the mortgage four years earlier.

This repayment strategy not only significantly reduces interest costs, but also helps borrowers get out of debt sooner and move closer to financial freedom.

Image source:news.com.au

Sally Tindall, Canstar’s Director of Research, noted that after banks cut rates in February, most borrowers chose not to reduce their repayments.

According to CBA data, only 14% of eligible customers requested to lower their direct debit amount following the February rate cut.

This trend reflects Australians’ forward-thinking approach to financial planning —choosing to pay extra on their home loans not only builds a stronger financial buffer, but also speeds up the journey to becoming mortgage-free.

Looking back at the past three years since the RBA began raising interest rates from historic lows in 2022, millions of households have struggled under the weight of rising mortgage repayments. It’s no surprise that the arrival of rate cuts has been eagerly anticipated across the country.

NAB CEO Andrew Irvine, in the bank’s interim results release, predicted that the RBA may lower the cash rate to 2.6% by early 2026.

However, Irvine also noted that if housing supply doesn't increase while demand rises, property prices are likely to go up.

He added that a 100 basis point rate cut this year alone could significantly push up house prices.

#03:

Rate Cuts to Fuel Property Market Surge

The combination of interest rate cuts, the upcoming federal election, and new buyer support schemes is set to boost property demand and prices significantly.

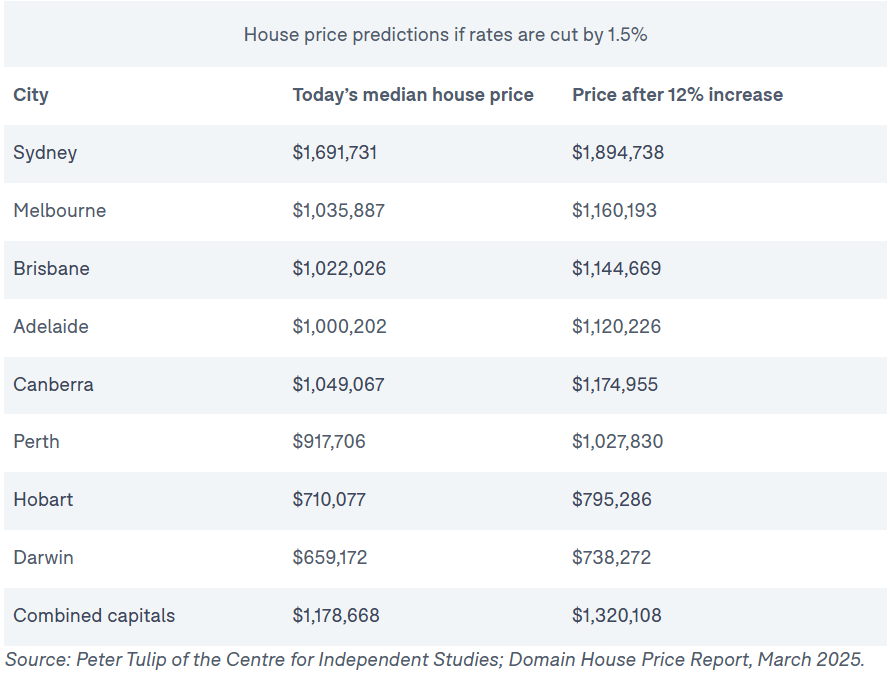

According to forecasts, if the official cash rate is cut by 1.5% by early 2026, property prices are expected to rise by 12% over the next two years.

As a result, some analysts and agents are urging prospective buyers to act quickly to avoid being priced out of the market.

According to data from Domain, a 12% increase on current prices would push the combined capital city median house price up by $141,000, reaching $1.32 million.

Image source:Domain

Dr. Diaswati Mardiasmo, Chief Economist at PRD, stated that rate cuts would significantly boost national demand, supply, and property prices.

Markets like Sydney and Melbourne are expected to benefit the most from this surge. Sydney, which has seen slower growth, may experience accelerated price rises, while Melbourne is likely to reverse its sluggish recovery.